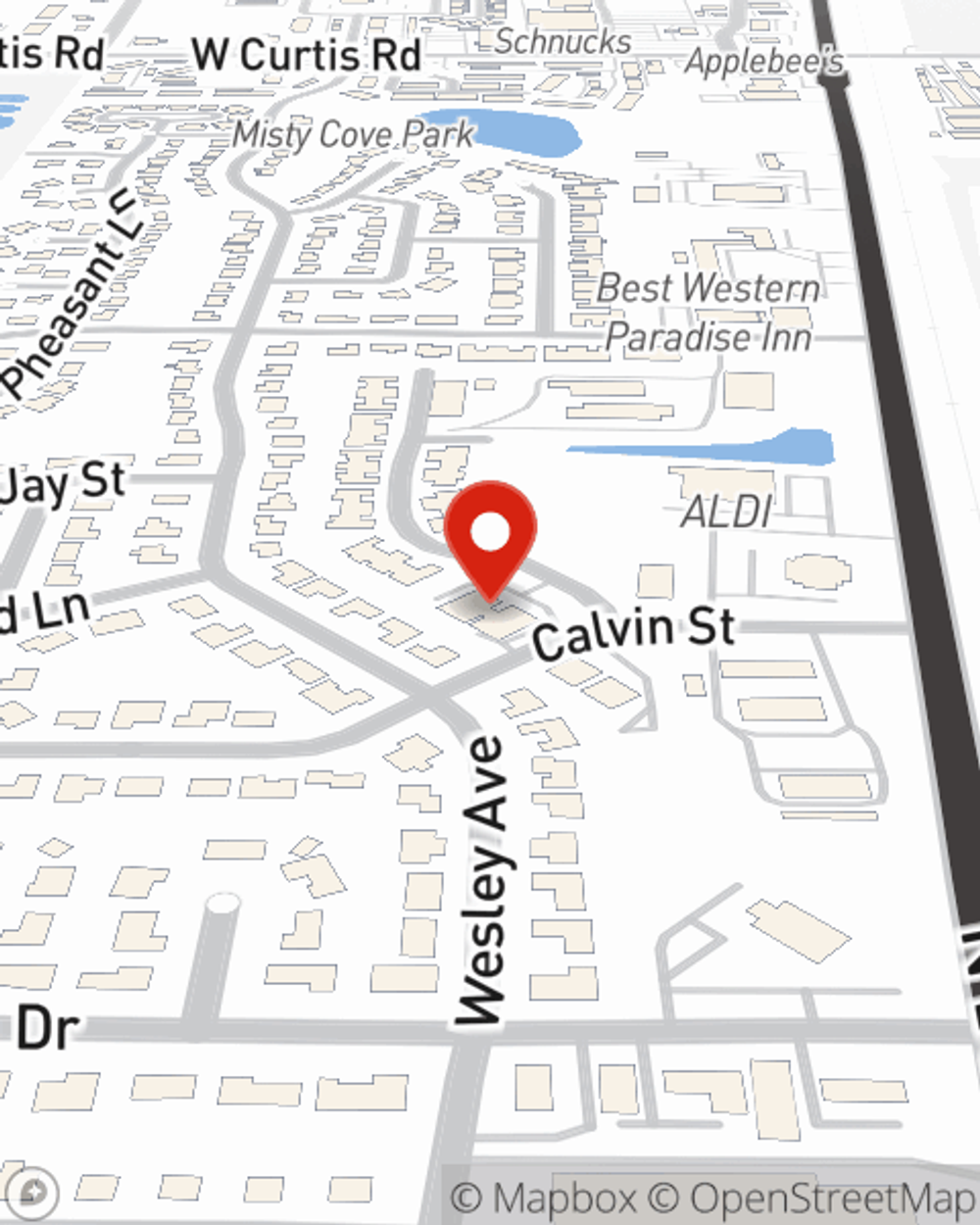

Life Insurance in and around Savoy

Life goes on. State Farm can help cover it

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

Investing in those you love is a big deal. You advise them on important decisions help them make decisions, and take time to plan for the future. That includes getting the proper life insurance to care for them even if you can't be there.

Life goes on. State Farm can help cover it

Now is the right time to think about life insurance

State Farm Can Help You Rest Easy

Fortunately, State Farm offers many policy choices that can be adjusted to align with the needs of your loved ones and their unique situation. Agent Todd Jacob has the deep commitment and service you're looking for to help you opt for coverage which can support your loved ones in the wake of loss.

Simply contact State Farm agent Todd Jacob's office today to experience how the State Farm brand can work for you.

Have More Questions About Life Insurance?

Call Todd at (217) 351-4800 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

Simple Insights®

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®